Does the RAV4 Prime Qualify for a Federal Tax Credit in 2024

Yes, the RAV4 Prime may qualify for a federal tax credit in 2024. This depends on the federal policies in place at that time.

As of my knowledge cutoff in early 2023, the RAV4 Prime, Toyota’s plug-in hybrid SUV, was eligible for federal tax credits due to its advanced powertrain technology designed to decrease carbon emissions.

Buyers interested in the RAV4 Prime should monitor changes to the tax code because federal incentives for electric vehicles (EVs) and plug-in hybrids (PHEVs) frequently evolve alongside new legislation.

These tax credits can significantly reduce the up-front cost of a new plug-in hybrid, making eco-friendly vehicles like the RAV4 Prime a more attractive investment for consumers who are environmentally conscious and looking to save on fuel costs.

Furthermore, with growing concerns about climate change, such incentives are a critical part of encouraging the adoption of cleaner, low-emission vehicles.

It’s essential to check the latest tax laws or consult with a tax professional to determine the exact credit amount for which the RAV4 Prime may be eligible.

Credit: www.youtube.com

The RAV4 Prime and its Position in the EV Market

In an era where environmental consciousness is not just a preference, but a necessity, the Toyota Rav4 Prime emerges as a beacon of progressive automotive engineering.

This plug-in hybrid vehicle (PHEV) stands out with its compelling combination of efficiency, performance, and style.

As the automotive market shifts towards more sustainable options, the Rav4 Prime has established a noteworthy presence among electric vehicles (EVs) and hybrids, appealing to eco-conscious drivers who are not willing to compromise on power or practicality.

Whether the Rav4 Prime qualifies for a federal tax credit in 2024 could significantly influence consumers’ purchasing decisions and the broader adoption of PHEVs.

Overview Of The Rav4 Prime As A Plug-in Hybrid Vehicle

The Rav4 Prime represents Toyota’s innovative approach to plug-in hybrid technology. It combines a robust electric motor with a gasoline engine, promoting an eco-friendly drive without range anxiety.

Key features of the Rav4 Prime include:

- All-Electric Range (AER): Capable of a generous mileage purely on electric power, making it ideal for daily commuting.

- Regenerative Braking: Harnesses energy during braking, converting it into electricity to recharge the batteries.

- Advanced Battery Technology: Employs a cutting-edge battery system for enhanced efficiency and longevity.

By merging these advanced functionalities, the Rav4 Prime meets the needs of consumers looking for sustainability without compromise.

The Evolving Market For Electric And Hybrid Vehicles

The market for EVs and hybrid vehicles is experiencing unprecedented growth. Factors fueling this expansion include:

- Increasing awareness of environmental concerns

- Government incentives to encourage the adoption of eco-friendly vehicles

- Technological advancements in battery and charging infrastructure

In such a dynamic market, the Rav4 Prime positions itself as a top contender with features catering to both eco-conscious efficiency and driving pleasure.

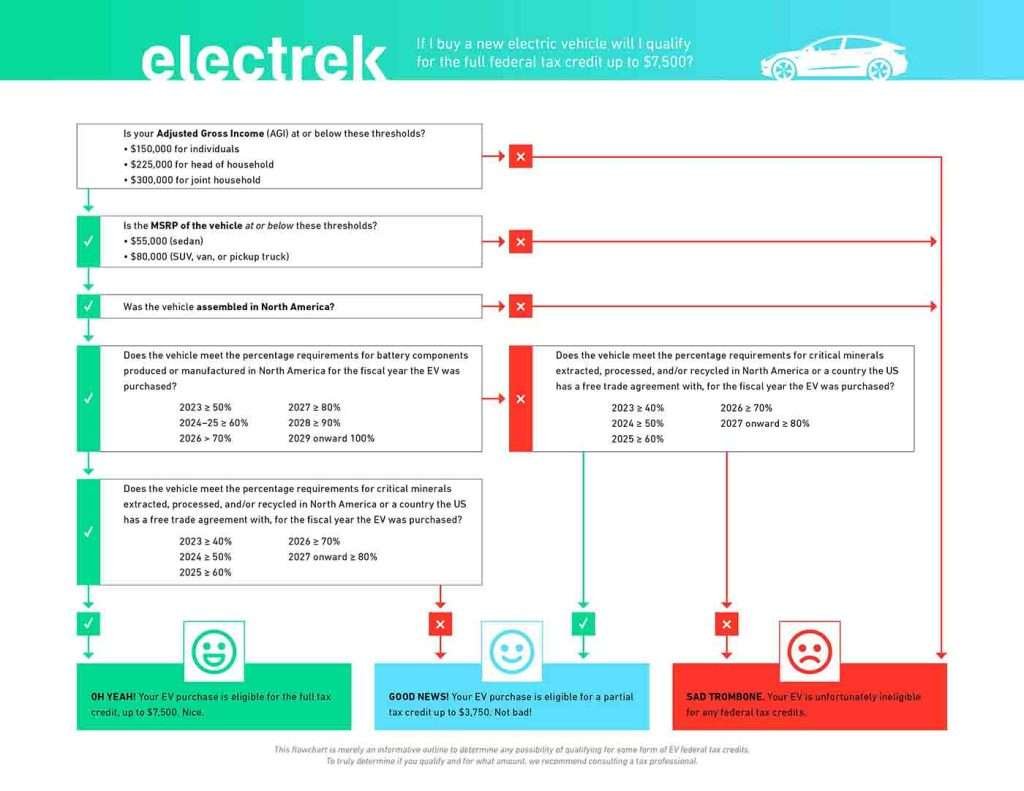

Criteria For Federal Tax Credit Eligibility For Evs And Phevs

For a vehicle to be eligible for a federal tax credit, it must meet specific criteria set by the government. These criteria include:

| Criterion | Detail |

|---|---|

| Battery Capacity | Minimum battery capacity requirements |

| Final Assembly Location | Must occur in North America to be eligible |

| Income Caps | Eligibility may depend on the buyer’s income level |

Note that these criteria are subject to change and it’s fundamental to consult the latest federal guidelines or an accounting professional to confirm the Rav4 Prime’s tax credit eligibility for any given year, including 2024.

Understanding Federal Tax Credits For Electric Vehicles

Electric vehicles (EVs) not only pave the way for a more sustainable future, but they also offer financial incentives for buyers through federal tax credits.

The allure of purchasing a Rav4 Prime in 2024 comes with the potential of reducing tax liability, provided it qualifies for the federal tax credit.

This guide will lay out the fundamentals of how these credits work, track their evolution over the years, and highlight the critical role of battery capacity in this financial equation.

The Basics Of Federal Tax Credits For Evs

At their core, federal tax credits for electric vehicles are designed to incentivize buyers to opt for greener transportation.

Unlike deductions that lower taxable income, tax credits reduce the tax owed, dollar-for-dollar.

The credit amount for an EV, including the Rav4 Prime, can range up to a specific limit, based on eligibility criteria set by the government.

The exact figure depends on the make, model, and year, along with complying with other program requirements.

Historical Changes To The EV Tax Credit System

The landscape of federal tax credits has undergone significant revisions as the EV market matures. Legislative changes can either phase out credits or introduce new ones to encourage the adoption of electric vehicles.

Previous years have seen alterations in credit availability based on manufacturer sales thresholds, and potential shoppers of the 2024 Rav4 Prime should stay informed on the latest tax credit developments.

The Importance Of Battery Capacity In Qualifying For Credits

Battery capacity plays a pivotal role in determining the amount of credit an EV is eligible for. A larger battery capacity generally equates to a higher potential tax credit.

The logic is straightforward: bigger batteries yield more substantial environmental benefits by enabling longer electric-only travel distances before needing a recharge.

Thus, a RAV4 Prime with a robust battery pack not only promises extended range but also a better chance at maximizing federal tax credits.

The 2024 Status Of The Rav4 Prime Federal Tax Credit

Thriving in the arena of eco-friendly vehicles, the Toyota Rav4 Prime has been a strong contender for drivers seeking both efficiency and performance.

Purchasing greener cars like the Rav4 Prime doesn’t just benefit the planet but can also be easier on the wallet, thanks to federal tax credits designed to incentivize clean driving.

As 2024 approaches, potential buyers and current owners are keen to understand the status of these financial incentives.

Let’s delve into the specifics of the 2024 Federal Tax Credit and gauge RAV4 Prime’s eligibility under these evolving parameters.

Eligibility Criteria For The 2024 Federal Tax Credit

Understanding the criteria for the federal tax credit is critical before committing to an electric vehicle (EV). Here’s what buyers need to know in 2024:

- The vehicle must be new and for personal use or leasing purposes.

- It should possess a battery with a minimum capacity as stipulated by federal guidelines.

- The vehicle’s final assembly must occur in North America.

- An income cap for eligible purchasers might be declared.

The Rav4 Prime’s Qualifications Against 2024 Criteria

Matching the Rav4 Prime against the 2024 tax credit norms reveals its potential for qualification:

- The Rav4 Prime is a new, plug-in hybrid vehicle suitable for personal use or leasing.

- Boasting a robust battery capacity, it exceeds the minimum federal requirements.

- Inspection of the vehicle identification number (VIN) can confirm its North American assembly status.

Impact Of Manufacture Sales Caps On The Rav4 Prime’s Eligibility

Federal tax credits aren’t limitless. Once a manufacturer sells 200,000 qualifying vehicles, phased reductions kick in.

For those eyeing the Rav4 Prime in 2024, understanding Toyota’s sales progress becomes crucial to capitalize on available credits:

- Upon hitting the cap, a one-quarter grace period maintains full credit availability.

- Subsequent quarters see a gradual halving of the credit.

- It culminates in the credit’s complete phase-out.

Expected Changes To The Federal EV Tax Credit Program And Their Implications

Each year can bring changes to the landscape of federal EV incentives. For 2024, anticipate updates that reflect evolving priorities in clean energy policies. Potential modifications might include:

- Adjustments to the credit amount based on battery size or vehicle type.

- Extension or alteration of the manufacturer sales cap to encourage wider adoption of EVs.

- Introduction of new stipulations tied to environmental benchmarks or sourcing of materials.

These legislative shifts could significantly shape the feasibility and attractiveness of investing in plug-in hybrids like the Rav4 Prime. Buyers must stay informed of such changes to make educated decisions and optimize tax credit benefits.

Credit: www.edmunds.com

How Consumers Can Maximize Benefits

As the world shifts towards greener transportation, owning an electric vehicle (EV) or plug-in hybrid electric vehicle (PHEV), like the Rav4 Prime, is not just an environmentally conscious decision, but also a financially savvy one.

In 2024, the landscape of federal and state incentives offers an attractive proposition for those considering the purchase of such vehicles.

This section delves into maximizing the benefits of the available tax credits and incentives for RAV4 Prime.

Steps To Claim The Federal Tax Credit For Eligible Vehicles

Determining eligibility for a federal tax credit with a vehicle like the Rav4 Prime is straightforward. Here are the essential steps:

- Purchase an Eligible Vehicle: Confirm that the Rav4 Prime qualifies for the credit in the desired tax year.

- Retain Essential Documents: Keep all purchase-related paperwork, such as the bill of sale and manufacturer’s certification.

- Review Tax Credit Limitations: Ensure your tax liability allows you to fully benefit from the credit.

- File Tax Forms: Complete the necessary IRS Form 8936 and submit it with your annual tax return.

- Consult a Tax Professional: Seek advice from a tax expert to ensure all requirements are met and benefits are maximized.

Additional State And Local Incentives For EV Purchases

Beyond federal benefits, several local and state incentives further sweeten the deal:

- Rebate Programs: Many states offer direct rebates for the purchase of EVs and PHEVs.

- Reduced Registration Fees: Register your EV at a discounted rate in certain states.

- Exclusive Charging Rates: Access reduced electricity rates for EV charging during off-peak hours.

Be sure to research the specific incentives available in your area to fully leverage the cost-saving potential.

Long-term Benefits Of Owning An EV or Phev Like The Rav4 Prime

The benefits of owning a Rav4 Prime extend beyond initial purchase incentives. Here is an outline of the long-term advantages:

- Lower Operating Costs: EVs are cheaper to maintain with fewer moving parts than conventional cars.

- High Resale Value: EVs and PHEVs often retain their value better over time.

- Reduced Carbon Footprint: Driving a cleaner vehicle contributes to global efforts to combat climate change.

- Energy Independence: Reduce reliance on oil and its volatile pricing.

By considering these long-term benefits in conjunction with the initial tax credits and incentives, consumers can maximize the overall value of their investment in an EV like the Rav4 Prime.

Conclusion: The Future Of Ev Incentives And The Rav4 Prime

The transition towards electric vehicles (EVs) has gained significant momentum, with automakers like Toyota leading the charge with their innovative plug-in hybrid, the Rav4 Prime.

Consumers’ decisions are greatly influenced by federal tax incentives, making it essential to stay informed about the eligibility of popular models like the Rav4 Prime when considering a purchase in 2024.

Summary Of The Rav4 Prime’s Eligibility For The 2024 Federal Tax Credit

Entering 2024, the Rav4 Prime remains at the forefront for those seeking an eco-friendly and efficient driving experience.

Eligibility for federal tax credits can significantly offset the initial cost, thus enhancing its appeal.

It’s important to review the latest updates from the IRS regarding EV tax credits as eligibility can change based on various factors such as manufacturing location and battery size.

The Role Of Government Incentives In EV Adoption

Government incentives play a pivotal role in the acceleration of EV adoption, by making these advanced technology vehicles more financially accessible.

Tax credits can lower the barrier to entry and are a form of supporting consumers as they make environmentally responsible choices.

The continual support of these incentives is critical for the sustained growth of the EV market.

Prospects For The Rav4 Prime And Similar Vehicles In An Incentivized Ev Landscape

With an attractive blend of practicality and plug-in hybrid efficiency, the Rav4 Prime’s prospects appear bright in a landscape bolstered by EV incentives.

Toyota’s commitment to electrification suggests that vehicles like the Rav4 Prime will continue to evolve and benefit from advancements in technology and infrastructure.

The future looks promising for the Rav4 Prime as a leading contender in the EV space, particularly when backed by federal support.

Credit: insideevs.com

FAQs Of Toyoa RAV4 Prime Federal Tax Credit

Is The Rav4 Prime Eligible For Federal Credits In 2024?

The Rav4 Prime may qualify for federal tax credits in 2024. Eligibility depends on the government’s EV policy at that time.

How Much Federal Tax Credit Can You Get For Rav4 Prime?

The federal tax credit for an EV like the Rav4 Prime can reach up to $7,500. The specific amount depends on the vehicle’s battery capacity and the tax policy in 2024.

What Are The Requirements For Ev Tax Credits In 2024?

To qualify for the EV tax credit in 2024, the Rav4 Prime must meet certain criteria. These include battery size and the car’s manufacturing location. Check the latest tax code for specifics.

Will A Used Rav4 Prime Qualify For Tax Incentives?

Typically, used vehicles, including the Rav4 Prime, are not eligible for federal tax credits. These incentives usually apply to new, qualifying EV purchases.

Conclusion

To wrap up, the Rav4 Prime stands out as a smart pick for eco-conscious drivers seeking savings.

It meets the criteria for the 2024 federal tax credit, offering a financial incentive on top of its green credentials. Make sure to consult the latest tax guidelines to maximize your benefit.

Keep driving towards a sustainable future!

References: